Business asset depreciation calculator

D i C R i. It provides a couple different methods of depreciation.

Depreciation Formula Calculate Depreciation Expense

For example the first-year.

. 2 x 010 x 20000 4000. How to Calculate Asset Depreciation. Compare depreciation amounts between the prime cost and diminishing value methods.

Determine balancing adjustment amounts. Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance. Business Use - If the asset is not used entirely for business enter the percentage that is for business use.

You can take a deduction. Enter the initial purchase price the amount you purchased the asset for Enter the salvage value how much you expect youll be able to sell the asset for. The calculation would be as follows.

Calculate the decline in value on multiple assets. Depreciation rate finder and calculator. If a business uses an asset.

First year depreciation M 12 Cost - Salvage Life Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8 years. Per unit depreciation formula has. R i is the.

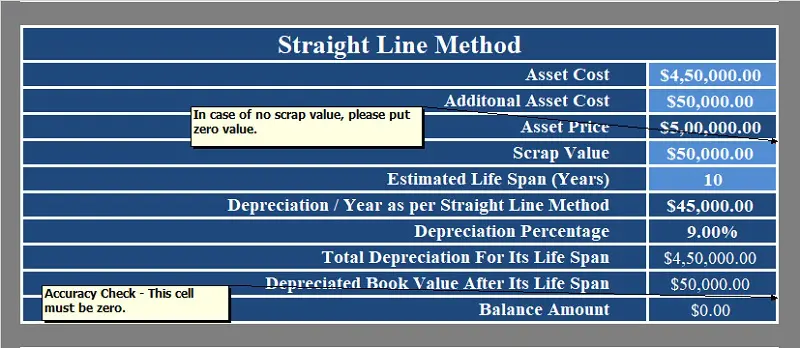

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3. Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method.

You use one half of your apartment. Choose the icon enter Fixed Assets and then choose the. That leaves a book.

Where D i is the depreciation in year i. Unit of Production Depreciation Formula. You buy a copy machine for 1600 at the end of March.

The MACRS Depreciation Calculator uses the following basic formula. You figure your share of the cooperative housing corporations depreciation to be 30000. First one can choose the straight line method of.

To test it out. Divide this number by the useful life of. To understand the unit of production depreciation formula better we will break it down into two parts.

At that point you think you can get 300 for it at resale. Setup needs to be done to calculate additional depreciation for Fixed Assets. View the calculation of any gain or loss.

To use the calculator you will need to enter the value of the asset and then the percentage of depreciation for each year. If your asset needs depreciating for more than 5 years calculate. To calculate your monthly depreciation amount the formula is.

Yearly Depreciation Value remaining lifespan SYD x. 1500 300 3 years 400year. If you enter 100000 for basis and business use is 80 then the basis for.

Your adjusted basis in the stock of the corporation is 50000. Assuming the machine has a salvage value of 400 you can depreciate 1200 of the cost over the life of the copier. To set up Additional Depreciation.

Find the assets book value by subtracting its salvage price from the price you paid for the asset. This depreciation calculator is for calculating the depreciation schedule of an asset. Using straight-line depreciation your depreciation cost would be 400 per year.

4000 12 33333. C is the original purchase price or basis of an asset. To calculate straight-line depreciation.

View Monthly Detail For Fixed Asset Depreciation Calculation Depreciation Guru

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

Asset Depreciation Schedule Calculator Template

Free Depreciation Calculator In Excel Zervant

Depreciation Formula Calculate Depreciation Expense

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Schedule Free Depreciation Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

How To Prepare Depreciation Schedule In Excel Youtube

Download Depreciation Calculator Excel Template Exceldatapro